Does this make you nostalgic?

Hearing the screeching sound of the old dial-up struggling to connect to the internet.

Remember those days? Fighting with siblings for a turn on the one family computer.

Slow websites. Frozen pages. Dropped connections. The early days of the internet were rough.

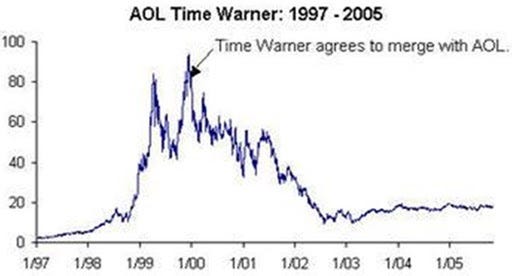

But if you had the foresight to invest in AOL during those days, you could’ve made good money. AOL went from a few bucks a share in 1997 to nearly $100/share (split-adjusted) by 2000, before merging with Time Warner and dropping during the dot-com bubble.

Of course, that’s not the only example.

Investors who backed new types of companies like Amazon (AMZN), Google (GOOG), and Cisco Systems (CSCO) when the web was in its infancy made life-changing money.

The lesson: It paid to make smart bets on the internet when it was still messy.

Crypto is a lot like the early days of the internet.

Not user friendly. Messy. Takes effort to navigate.

According to Chief Analyst Stephen McBride, that’s our opportunity.

Crypto’s come a long way in the last few years.

There are now 562 million crypto holders worldwide — a number that grew 33% in 2024.

But there’s still a long way to go. Stephen:

Today, the crypto user experience sucks.

There’s no way a billion people will use crypto in its current form. And that’s our opportunity.

Just like the internet, crypto will become much easier to use. This is going to attract hundreds of millions of new users, fueling years of rapid growth for crypto businesses.

By investing now, you can set yourself up to profit from this growth. The vast majority of investors won’t put the effort in. That’s why they’ll only ever read about the big money crypto investors can make.

The frustrating user experience means we’re still very early to crypto.

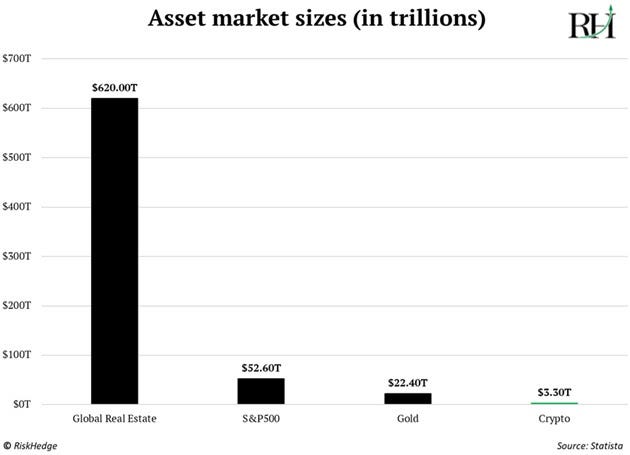

Relative to real estate, the S&P 500, and gold… crypto is barely a blip:

In fact, Microsoft (MSFT) — one company — is larger than the entire crypto market. So is Nvidia (NVDA). And Apple (AAPL) isn’t far behind.

So crypto is new(ish), small, and rapidly improving.

That makes it a great source of potentially asymmetric returns.

In investing, “asymmetric” means the potential upside of an investment is much greater than the potential downside.

Symmetric investing is when an investor risks $500 for a chance to make $500. Or $10,000 for a chance to make $10,000.

Asymmetric investing is risking $500 for the chance to make $10,000.

Of course, booking 1,000%+ gains is easier said than done, and it requires taking greater risk.

That’s why asymmetric investments should be no more than a small part of your overall portfolio. Stephen recommends putting only 1%–2% into crypto, max.

Depends on the time frame.

Bitcoin trades for about $109,000 right now. Stephen expects it to hit at least $200,000 in the next 12 months. That’s about double. Symmetric.

Given time, could bitcoin reach $1 million? If its adoption curve continues, absolutely. But it’s highly unlikely to shoot up 10X or more quickly, as small cryptos often do.

Stephen says the #1 asymmetric opportunity today is in the smaller, lesser-known cryptos.

He wrote about 3 such cryptos in this report.

The crypto market is still so small and so new, there’s room for exponential growth.

— RiskHedge Research

What the Dot-com era can tell us about crypto today was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Also read: They’ve Truly Taken over Bitcoin