Ultrade is unveiling cutting-edge Native Exchanges (NEX) technology, combined with Whitelabel SaaS infrastructure and a sustainably scalable B2B2C business model. Ultrade solves critical challenges faced by crypto traders and numerous tokenized projects across the market.

Incubated by Decubate

Link

Despite the booming cryptocurrency market, billions of dollars are lost annually by traders and projects, primarily due to the extractive practices of CEXs & DEXs.

Projects aiming to list on CEXs face significant financial hurdles, including hefty “marketing” listing fees, which often result in token dumping. Additionally, the cost to list can reach up to $2 million, and projects are required to redirect their users to third-party exchanges, leading to decreased user retention and increased friction.

On the other hand, projects listing on DEXs encounter various challenges such as MEV attacks targeting project investors, initial liquidity sniping, and poor cross-chain user experience.

Traders operating on CEXs face issues such as hidden frontrunning by the exchanges, and relinquishing custody over assets, exposing them to risks of fraud and theft. Similarly, traders on DEXs are susceptible to MEV attacks, sniping new listings, and bear high trading fees and gas costs, further exacerbating the financial strain.

This vicious cycle of value extraction perpetuates the challenges faced by market participants, hindering the growth and stability of the cryptocurrency ecosystem.

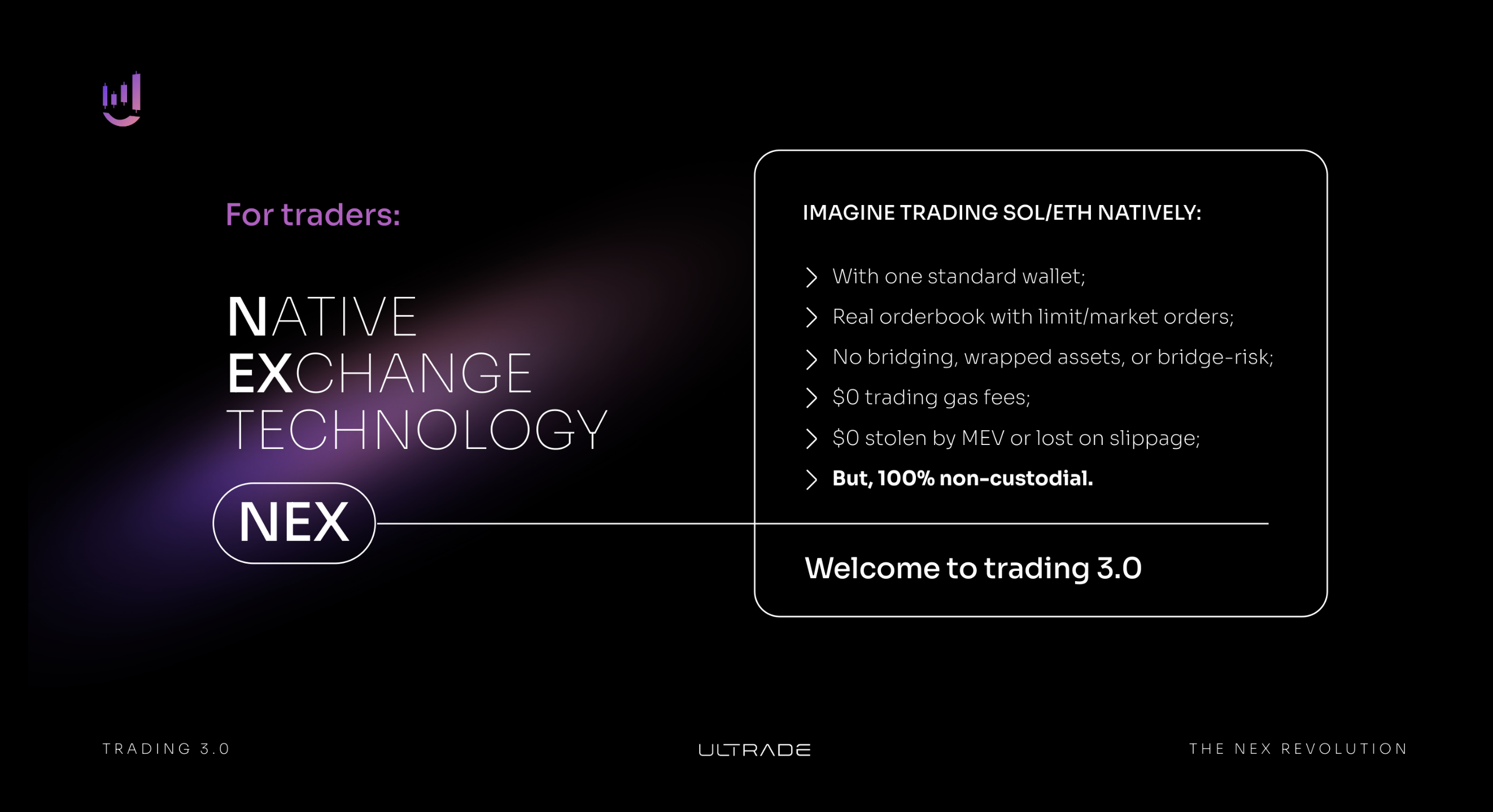

Introducing a revolutionary trading technology called Native Exchanges (NEX) that surpasses the limitations of both CEXs and DEXs, offering enhanced benefits for traders while empowering projects with ownership and control. Ultrade’s innovative solution is developed as a white label infrastructure, providing projects with the ability to launch and brand their NEX within just 10 minutes, without requiring any development expertise or incurring costs.

Now for the first time ever, projects can set their own trading fees and unlock a new revenue stream while maintaining autonomy over their exchange operations. They can self-list their tokens for trading and enjoy co-listings from other partners, thereby maximizing exposure and liquidity through network effects.

Gasless trading experience, Real order book with limit & market orders, No bridging, wrapped assets, or bridge-risk, Zero value stolen by MEV or lost on slippage & [Pipeline] Enhanced Trading Tools: Spot, Perpertual Swaps & 5x Margin.