Ethereum Classic (ETC) is a popular, open-source, decentralized, blockchain-based cryptocurrency platform that utilizes smart contracts. In essence, it’s a hard fork of the Ethereum blockchain that maintains a Proof-of-Work (PoW) consensus mechanism and capped supply. Over the past month, Ethereum Classic has surged from its April low of $14.06 to a peak of $ 20.7 (+47%), before stabilizing around $16. This upward momentum highlights shifting market sentiment and renewed investor confidence in the project’s fundamentals. In this analysis, we will share the basic information about this popular digital asset and provide an updated Ethereum Classic price prediction based on current market trends.

| Current ETC Price | ETC Price Prediction 2025 | ETC Price Prediction 2030 |

| $16.3 | $40 | $200 |

Ethereum Classic is a decentralized, blockchain-based platform that operates on a PoW consensus mechanism, similar to Bitcoin, and supports smart contracts and dApps, though with a stronger emphasis on immutability and censorship resistance.

Despite sharing Ethereum’s early history, Ethereum Classic has evolved as a separate project with its own community and development roadmap. It has faced challenges, including multiple 51% attacks due to its smaller hash rate, but has since implemented security upgrades like Modified Exponential Subjective Scoring (MESS) to deter such threats.

| Current Price | $16.3 |

| Market Cap | $2,490,512,506 |

| Volume (24h) | $56,354,778 |

| Market Rank | #37 |

| Circulating Supply | 152,545,484 ETC |

| Total Supply | 210,700,000 ETC |

| 1 Month High / Low | $18.7 / $14.51 |

| All-Time High | $176.16 May 06, 2021 |

Ethereum Classic originated from the original Ethereum blockchain but split after the 2016 DAO hack. A contentious debate followed, leading to a hard fork where 85% of miners supported creating a new chain, which retained the Ethereum name. The original chain continued as Ethereum Classic, preserving the principle of immutability.

Ethereum Classic offers several features within the crypto space:

CoinGecko, July 2, 2025

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $14.57 | $68.98 | $40 | +145% |

| 2026 | $28.15 | $163.48 | $100 | +510% |

| 2030 | $77.04 | $315.63 | $200 | +1,100% |

| 2040 | $513.32 | $10,343 | $5,500 | +33,500% |

DigitalCoinPrice experts anticipate Ethereum Classic may trade between $14.57 (-10%) at its 2025 low and $35.66 (+120%) at peak valuation.

PricePrediction crypto analysts project strong performance, with ETC expected to range from $19.61 (+20%) at its low to $22.99 (+40%) during 2025.

Telegaon crypto experts expect that ETC crypto will also rise in price: according to their estimates, the lowest price Ethereum Classic can hit in 2025 is $25.85 (+55%), while its maximum price will hit $68.98 (+320%).

DigitalCoinPrice experts project that in 2026, ETC may reach $41.57 (+155%) at peak valuation, while potentially declining to $34.7 (+110%) at its lowest point.

According to PricePrediction analysts, in 2026 ETC will reach $34.2 (+110%) at its highest point or go to $28.15 (+70%) at its lowest price level.

Telegaon’s optimistic price projection indicates Ethereum Classic could reach a minimum of $69.71 (+325%) and potentially surge to $163.48 (+900%) by 2026. This bullish forecast reflects growing market confidence and anticipated broader adoption of ETC within the cryptocurrency ecosystem.

According to DigitalCoinPrice, ETC could reach a maximum price target of $87.69 (+435%), while maintaining a robust floor of approximately $77.04 (+370%) even under more conservative market conditions. This optimistic outlook reflects anticipated developments in ETC’s ecosystem, including potential technological upgrades, growing institutional recognition, and broader adoption as a store of value within the PoW blockchain sector.

PricePrediction experts state that by 2030, the ETC coin will reach its lowest price of $118.25 (+620%), while it can also peak at $145.84 (+790%).

Telegaon’s 2030 price forecast for Ethereum Classic presents an exceptionally bullish trajectory, projecting a maximum valuation of $315.63 (+1,830%). Even under more conservative scenarios, their analysis suggests a substantial floor of $266.15 (+1,525%).

PricePrediction’s ultra-bullish 2040 forecast suggests ETC could reach between $8,209 (+50,000%) and $10,343 (+60,000%), implying transformative growth potential over the next two decades.

In contrast, Telegaon’s more conservative modeling anticipates 2040 valuations in the $513.32 (+3,000%) to $546.89 (+3,250%) range. This tempered outlook may reflect different weighting of variables including competitive pressures, regulatory landscapes, and the long-term viability of PoW consensus mechanisms.

Ethereum Classic has drawn mixed but cautiously optimistic forecasts from analysts amid its recent price volatility. Some experts highlight its resilience as one of the oldest smart contract platforms, arguing that its PoW consensus mechanism retains appeal for security-focused investors. ETC is also one of the oldest blockchain networks, maintaining the original Ethereum code after the 2016 hard fork. It operates as a decentralized platform for smart contracts, similar to Ethereum, but with a focus on immutability and security. Despite facing challenges such as lower adoption rates and security concerns, Ethereum Classic has remained a significant player in the crypto market.

While long-term price speculation remains uncertain, some analysts, including experts at CoinLore, suggest Ethereum Classic’s native token could hit $315 by 2030 and could go even higher by 2040: according to their estimations, it’s expected to reach a whopping $1,100 per coin.

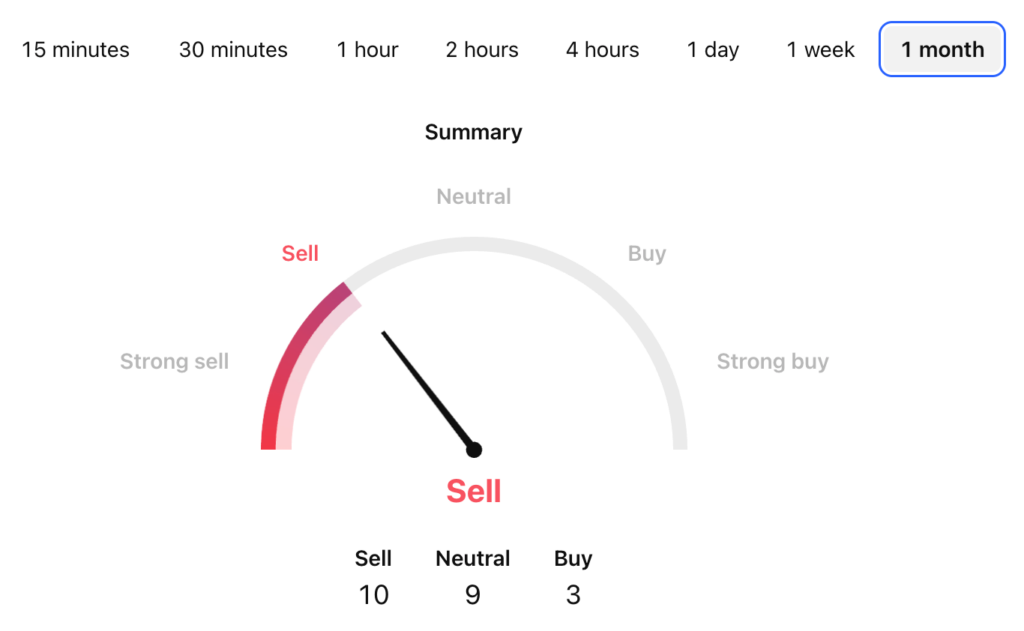

Tradingview, July 2, 2025

Now that we’ve taken a look at the possible future of the Ethereum Classic coin, let’s find out a bit more about the factors that can lead to its further success.

The price of Ethereum Classic is influenced by a combination of technical, fundamental, and macroeconomic factors. As a PoW blockchain, its valuation is closely tied to mining economics (including hash rate stability, energy costs, and miner participation) which directly impacts network security and investor confidence. Key demand drivers include its role as a store of value within the Proof-of-Work ecosystem, smart contract utility, and ongoing development activity. Additionally, broader cryptocurrency market trends, particularly Bitcoin’s price movements and Ethereum’s transition to PoS, create spillover effects on ETC’s market performance. Regulatory developments concerning PoW cryptocurrencies and institutional adoption trends further contribute to price volatility.

Market sentiment and speculative trading also play significant roles, as ETC remains a favored digital asset among certain investor segments who value its immutability principle and ideological alignment with Bitcoin’s original vision. Moreover, the token’s fixed supply cap creates scarcity dynamics, while exchange listings and liquidity depth amplify short-term price movements. However, persistent challenges, including relatively lower developer activity compared to ETH, competition from Layer-2 solutions, and historical 51% attack vulnerabilities, continue to present challenges.

Ethereum Classic presents several opportunities for investors and developers, particularly due to its commitment to decentralization and immutability. Unlike Ethereum, which has transitioned to a PoS model, ETC continues to operate on PoW, making it an attractive option for miners seeking an alternative after Ethereum’s shift. Additionally, its fixed monetary policy, which limits the total supply of ETC, positions it as a potential store of value, similar to Bitcoin. The network also benefits from ongoing development efforts aimed at improving security and scalability, helping it remain relevant in the evolving blockchain space. As the adoption of dApps and smart contracts grows, Ethereum Classic has the potential to carve out a niche for projects that prioritize censorship resistance and an unalterable blockchain history.

However, Ethereum Classic also faces significant risks, including lower adoption and network security concerns. With fewer developers and users compared to Ethereum, ETC has struggled with slower innovation and limited ecosystem growth. Furthermore, competition from other smart contract platforms, particularly Ethereum and newer blockchains with advanced scalability solutions, could limit ETC’s long-term growth. While Ethereum Classic remains a strong advocate for blockchain immutability, its success will depend on its ability to attract developers, enhance security, and find unique use cases in a rapidly evolving industry.

Ethereum Classic could be a worthwhile investment for those who believe in the long-term value of PoW blockchains and prioritize decentralization and immutability, particularly given its fixed supply cap and ideological alignment with Bitcoin’s original principles. However, it carries significant risks, including lower developer activity compared to Ethereum (ETH), lingering security concerns from past 51% attacks, and increasing regulatory scrutiny around energy-intensive Proof-of-Work networks. Some investors see it as a long-term store of value, while others view it as a speculative asset with high volatility. If the network improves security, gains more developer interest, and finds unique applications, it could see growth. However, the future of many crypto projects is uncertain due to the volatility of cryptocurrencies.

Ethereum Classic maintains a viable future, though its sustained success hinges on critical factors such as ecosystem adoption, enhanced security protocols, and competitive positioning. As the original Ethereum blockchain is preserved, ETC upholds core principles of immutability and decentralization, qualities increasingly valued in an era of growing institutional blockchain intervention. However, challenges persist, notably diminished developer engagement compared to ETH and historical vulnerabilities, which continue to impact investor confidence.

ETC trades at a relatively low price compared to Ethereum and other major cryptocurrencies due to several key factors, including lower adoption, reduced developer activity, and lingering security concerns.

Ethereum Classic hit its all-time high of $176.16 on May 06, 2021.

Ethereum Classic reaching $100 is a possible scenario, but it depends on several factors, including overall crypto market trends, investor sentiment, and network development. Historically, ETC has surged during strong bull markets, reaching an all-time high of around $176 in May 2021. For ETC to hit $100 again, it would require significant adoption, increased trading volume, and a favorable market environment. Its fixed supply (capped at 210M coins) provides scarcity value, so it is a possible scenario in a bullish market.

Ethereum Classic hitting an impressive price threshold of $1,000 would require an enormous market capitalization increase, likely driven by massive adoption, technological advancements, and a significant crypto bull run. Given its historical price movements, ETC has shown strong growth in past cycles, but it also faces challenges like lower developer activity, security concerns, and competition from Ethereum and other smart contract platforms. All in all, for Ethereum Classic to achieve the $1,000 price milestone, it would necessitate an unprecedented surge in market capitalization, fueled by widespread adoption, groundbreaking technological upgrades, and a sustained crypto supercycle.

Ethereum Classic reaching $5,000 is theoretically possible but would require an unprecedented and near-perfect alignment of market conditions, including a multi-trillion-dollar crypto market cap, mass institutional adoption of its PoW model, and a collapse in competing smart contract platforms like Ethereum.

Ethereum Classic reaching $10,000 is extremely unlikely. For this to happen, ETC’s market capitalization would need to reach trillions of dollars, surpassing not only Ethereum but potentially rivaling the entire crypto market’s current size.

Ethereum Classic (ETC) reaching $20,000 per coin is virtually inconceivable under any realistic market conditions, as it would require an enormous market capitalization, more than triple Bitcoin’s all-time high and nearly half of global gold’s total value. Such a price would imply ETC not only overtaking Ethereum but becoming the dominant asset in all of crypto, despite its lack of DeFi/NFT ecosystems, slower development pace, and ongoing PoW-related regulatory risks.

Ethereum Classic reaching $50,000 is economically implausible, as it would require a gigantic market cap, surpassing Bitcoin’s peak by several times and exceeding the GDP of most major economies. While ETC’s fixed supply creates scarcity, its lack of ecosystem development, shrinking hash rate, and inability to compete with Ethereum’s DeFi/NFT dominance make such growth unimaginable. Even in a hypothetical scenario where PoW blockchains dominate global finance, ETC would still need to outperform Bitcoin, Ethereum, and every Layer-1 or Layer-2 solution; a near-zero probability outcome given its technological stagnation.

Ethereum Classic reaching $100,000 is fundamentally impossible under any realistic economic or technological scenario. A possible scenario would include hitting $1,000 within the next decade.

The price of $ETC could go up again, but like all cryptocurrencies, it is subject to high volatility and uncertainty. While ETC has shown the ability to rise during market rallies, its future price movements depend on several factors. If there are technological upgrades, an increase in developer activity, or broader adoption of dApps on the ETC network, the price could experience upward momentum.

Optimistic predictions suggest that ETC could potentially reach between $200 to $500 in favorable market conditions and continued network improvements. However, projections beyond these ranges, such as $1,000 or more, are speculative and would require substantial changes in adoption, security, and competition.

According to DigitalCoinPrice experts, in 2025 ETC will hit a maximum of $36.

PricePrediction experts think that in 2030 Ethereum Classic will go as high as $146 at its peak.

Telegaon analysts think that in 2035 ETC crypto will hit an all-time high of $537.

Telegaon analysts believe that in 2040 Ethereum Classic will hit $547 at its peak.

PricePrediction analysts believe that in 2050 ETC will peak at a staggering $14,800.

The choice between Ethereum and Ethereum Classic depends on investment goals and risk tolerance. ETH, as the dominant smart contract platform with PoS efficiency, DeFi/NFT dominance, and institutional backing, offers stronger fundamentals and adoption, making it a more stable long-term hold. ETC, while cheaper and appealing for its PoW immutability and fixed supply, carries higher risk due to lower developer activity, security vulnerabilities, and niche use cases. For most investors, ETH is the smarter choice for growth potential, while ETC remains a speculative bet on PoW purism or a potential hedge against ETH’s staking risks.

Despite its challenges, Ethereum Classic remains an attractive project for those who value blockchain’s original ethos: decentralization, immutability, and censorship resistance. Its PoW foundation and fixed supply mirror Bitcoin’s sound money principles, offering a hedge against the evolving shifts in the crypto landscape. While it may never surpass Ethereum in adoption, ETC’s persistence and upgrades (like MESS security) prove its resilience. As the industry matures, Ethereum Classic could carve out a niche as a store of value or a testing ground for smart contracts.

StealthEX is here to help you buy ETC coin if you’re looking for a way to invest in this cryptocurrency. You can buy Ethereum Classic privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

crypto price prediction ETC Ethereum classic price analysis price prediction